Bitcoin is often called “digital gold” – a reference not just to its scarcity and use as a store of value, but also its deflationary monetary properties. Like gold, Bitcoin has a strictly limited supply that is fundamentally distinct from fiat currencies which can be printed endlessly by central banks.

This deflationary hard cap on the Bitcoin supply is one of its most defining characteristics and a key reason it aligns with the teachings of the Austrian school of economic thought. Let’s explore the implications of Bitcoin’s fixed money supply through the lens of Austrian economics.

The Austrian View on Money Supply

A core tenet of Austrian economics is the rejection of artificially inflexible money supplies controlled by central authorities. Influential Austrian thinkers like Ludwig von Mises and Murray Rothbard argued that constantly expanding the money supply through bank lending and money printing inevitably leads to distorted price signals, wealth redistribution, and economic booms followed by painful busts.

In Mises’ scenario of the “crack-up boom“, once the public recognizes that a currency is losing value due to over-issuance by the monetary authority, they begin to dump it rapidly in favor of undervalued real goods – causing hyperinflation to spiral out of control. The only way to avoid this dire outcome, Austrians argue, is by ensuring a truly limited monetary supply governed by the market rather than artificial constraints.

This makes Bitcoin’s fixed supply of 21 million coins particularly attractive from an Austrian perspective. Its monetary policy cannot be manipulated, inflated or debased at will since the total supply and issuance schedule is predetermined by the protocol’s code itself. No central planner can simply “print” more bitcoins into existence.

The Rules of Bitcoin’s Hard Cap

Bitcoin’s capped maximum supply is enforced through several key rules hardcoded into the protocol:

1. Only 21 million bitcoins can ever be created. This is the absolute ceiling.

2. New bitcoins are released slowly through a predetermined issuance schedule, not all at once. They enter circulation through the block reward given to miners for validating transactions.

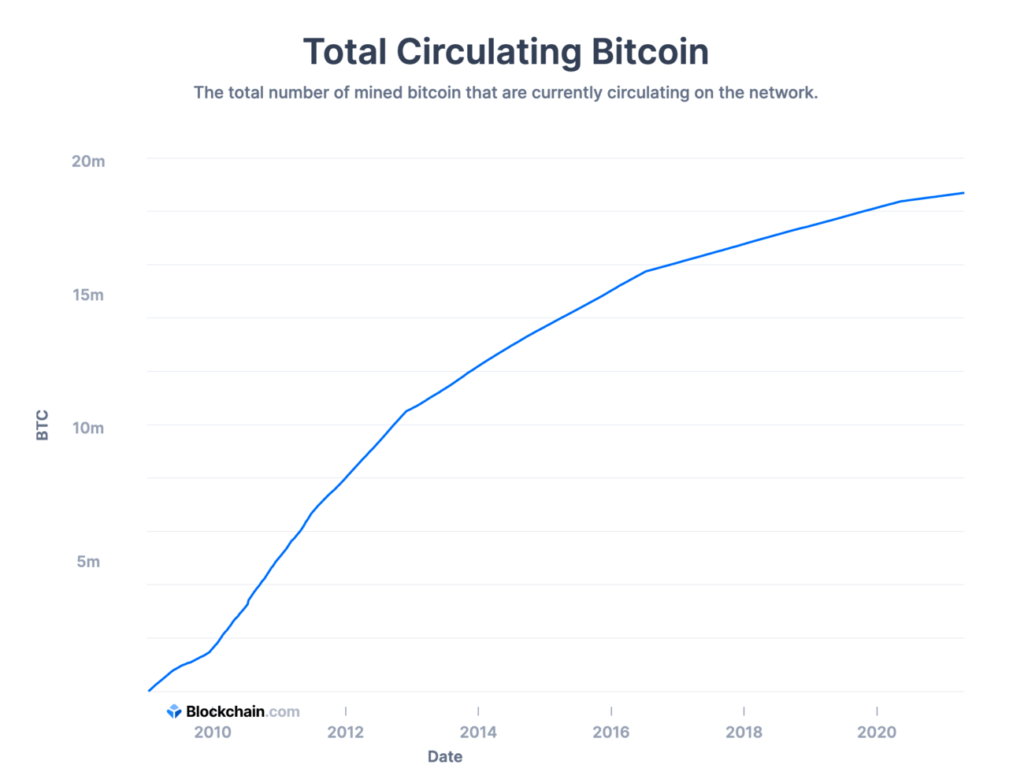

3. The block reward started at 50 BTC in 2009 and is cut in half every 210,000 blocks mined (about every 4 years) in an event called the “halving” or “halvening”. This geometric issuance rate continually slows over time.

4. The last bitcoin will be mined around the year 2140 after which no new BTC will ever be created. Regular block rewards to miners will then come solely from transaction fees.

This hard cap combined with diminishing new supply over time creates a disinflationary or deflationary monetary supply curve. Unlike fiat currencies which tend toward constant inflation by design, bitcoins are guaranteed to become more and more scarce relative to any growing economic output.

The result is essentially the digital money version of a perfectly inelastic supply, which is the ideal case argued by Austrian economists. With an unchangeable cap, Bitcoin supply cannot be influenced by monetary policy decisions or fractional reserve lending expansion which Austrians view as destructive to a stable, hard money system.

Time Preference and Bitcoin

Another Austrian principle that aligns with Bitcoin’s nature is the economic theory of time preference. Established by economist Eugen von Böhm-Bawerk, time preference refers to the human tendency to value present goods higher than future goods, all else being equal. We prefer to obtain something now rather than later.

This drives interest rates, as people must be incentivized through higher future value to willingly delay present consumption. It’s why $100 today is considered more valuable than $100 a year from now, and why interest must be paid on loans.

With Bitcoin’s scheduled halvings roughly every 4 years, time preference comes into play. Potential Bitcoin investors must decide if it’s worthwhile to obtain and hold the present supply of bitcoins knowing their future purchasing power will likely rise as supply issuance slows towards the 21 million.